- Limited range of tradable assets compared to some competitors

- Higher minimum deposit for certain account types

- No proprietary mobile app (relies on MT4/cTrader mobile)

FP Markets is a professional forex trading broker that has been providing service locally and internationally. However, the origin and local market of FP Markets is in Australia. Besides, it also operates in Europe and other Asian countries using the Cyprus Securities and Exchange Commission’s (CySEC) regulation. It was established back in 2005, and within these 15 years, they have gathered more than 12,000 loyal trader’s worlds. This immense number of traders should indicate the positive FP Markets review.

Overview:

- Headquarters: Sydney, Australia.

- Trading Platforms: MT4, MT5, WebTrader, cTrader , TradingView, IRESS

- Foundation Year: 2005

- Min. Deposit: $100

- Max. Leverage: 500:1

- Deposit Options: Visa, MasterCard, PayPal, bank/wire transfer, Neteller, Skrill, POLi, BPay, Fasapay.

Licenses

First Prudential Markets is the parent company, through which FP Markets do their business. They have the following two licenses from Australia and Cyprus.

First Prudential Markets Pty Ltd is registered with ASIC (Australia) with the registration no ABN 16 112 600 281 AFS 286354.

In Cyprus, they are registered as First Prudential Markets Ltd, which is authorized by CySEC (Cyprus) registration no 371/18.

Regulation

For a smooth operation and to gain the trust of the traders worldwide, FP Markets managed to get the registration from the world’s top tier regulatory bodies, which are the Australian Securities and Investments Commission (ASIC) and Cyprus Securities and Exchange Commission (CySEC), South Africa (FSCA) and Kenya (CMA).

These ensure that you are protected in accordance with the local and international laws and legislations. Besides, the regulations also enforce FP Markets to have a separate bank account for the traders in different banks or branches. To comply with this rule, FP Markets held an account with top tier banks such as Commonwealth Bank of Australia and National Australia Bank.

Account Types

FM Markets provide STP and ECN models for the clients. To provide these services, they offer two types of accounts, Standard and Raw, using MT4 MT5 platforms. From different FP Markets reviews, we have found that both accounts are almost the same except for the commission and spreads.

The standard account is a commission-free account, but you will have to count the spreads, which start from 1.0 pips. On the other hand, the Raw account is commission based, but the spreads start from 0.0 pips.

All other terms and conditions such as maximum leverage, trade size, execution, the minimum deposit remain the same.

How to open an FP Markets Account?

The account opening process is online, and you don’t need to go to the office or any physical location to verify. After filling up the form to open an account from their website, FP Markets may take 1-2 days to verify your information. Once they verify, you can deposit money and start trading. The information you will have to provide as per Know Your Customer (KYC) are-

- Name, address, phone number, country of residence

- Proof of address, your ID

- Select the account types you want

- Prove your financial experience by filling out a questionnaire

- FP Markets open an account

Trading Instruments

Once your account gets approved, you can trade any instruments you want from forex, bitcoin, commodities, indices, metals, and CFD. These instruments altogether offer 10,000+ products. However, the trading instruments propose flexible leverage and require a specific margin.

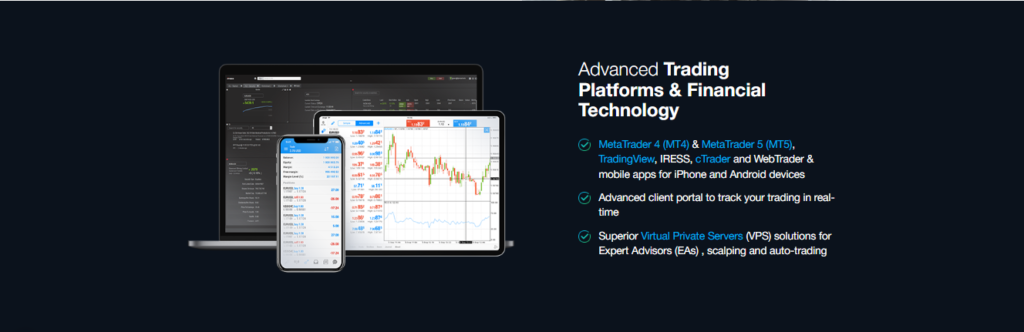

FP Markets Platforms

FP Markets keep the platform choice open for the users by offering three trading platforms MetaTrader 4, MetaTrader 5, TradingView and IRESS. MT4 and MT5 can be used as the forex trading platforms, while IRESS is used for the money managers for MAM and PAMM.

Web Trading Platform

All the platforms are accessible from any device from any browser. You will just have to log in using your ID and password and place the order or analyze the market via the browser.

Desktop Platform

Usually, in the past, the desktop platform was more user-friendly as it was the only service for the traders. However, the web platform took this place. But, still, a lot of the users prefer the desktop platform.

To use the desktop version, you have to download the software from your account by selecting your PC types such as MAC or Windows. Once installed on the PC, you can fully access your account id and password.

Mobile Platform

With the invention of the smartphone such as Android and iOS, the Meta Trader had to make the apps for the phones so that users can use traders right from the phones.

Whether you have iPhone, iPad, or Android phones or tabs, you can now trade from any device via the apps. Furthermore, if you don’t want to use MetaTrader, you can access the IRESS for indices, equities, and CFDs.

Commissions and Spreads

Spreads and commissions vary according to the account types. For example, the standard account doesn’t impose any commission at all. On the other hand, raw account charge commission for forex and metal instruments. However, the commission depends on the currency pairs and denominated currencies. For example, it is $3.50 for AUD, CAD, SGD, $3.00 for USD, and 2.75 for EUR. You will get notified before making any transaction.

Trading Fees

Among the top forex brokers list, FP markets offer competitive fees and charges. However, the fee structure is slightly different for the IRESS account as they change commission and percentages based on trading size.

But other fees are completive and lower than the competitors. FP markets usually rely more on spreads, and that varies by the account types. For example, for the EUR/USD in STP account, the floating spread is 0.7, and in the ECN account, the spreads for the same pair is 0.1.

Deposit and Withdrawal

After opening the account, you will need to deposit money to start trading. FP Markets offer a vast range of deposit options; however, we will recommend wire transfer, e-wallets such as Neteller and Skrill, and debit or credit cards.

However, FP Markets does not charge any transfer fees for card payment, while they charge for bank transfer and international transfer. The broker to broker transfer opportunity is available as per your request.

Keep in mind that the minimum deposit amount for any account is $100 for all types of accounts.

Education and Research

Learning forex and other trading is an endless task as the markets keep on changing. And it is great when you get the continuous learning opportunity from the broker. However, FP Markets offer educational tools for users as videos, tutorials, eBooks, newsletters, etc.

Customer Service Experience

FP Markets is one of those best forex brokers that offer speedy customer service via phone call, email, or live chat. FP Markets’ customer service is available for 24/7 in all languages.

Some of the features of customer services are

- International phone call support

- Supports in a different language

- Provide the appropriate solution in no time