- Limited product offerings.

- No investor protection for traders outside the European Union.

- No weekend trading, extra bonuses or promos.

- No app for proprietary trading.

Before you invest your hard-earned money, it’s essential to understand who you’re partnering with — and that’s where our detailed IC Markets review comes in.

Known for its competitive pricing and low minimum deposit, IC Markets makes forex trading accessible even for traders with smaller budgets.

The broker provides feature-rich trading platforms equipped with advanced tools and up-to-date trading facilities. In this review, we’ll cover everything from available trading products and platform features to account types and pricing structures — helping you determine whether IC Markets aligns with your trading needs.

Overview

- Headquarters: Sydney, Australia.

- Regulatory : FSA, ASIC, CySEC

- Trading Platforms: MT4, MT5, Mirror Trader, ZuluTrade, Web Trader, cTrader, Mac

- Foundation Year: 2007

- Min. Deposit: $200

- Max. Leverage: 1:500

- Deposit Options: Bank/wire transfer, Paypal, credit card, Skrill, Neteller, UnionPay, Bpay, FasaPay, and Poli.

Account Type

IC Markets offer raw pricing on an extensive amount of trading products through all the accounts. Mainly they provide 1. raw spread account and 2. standard account.

Raw spread account

The account offers ten base currencies, i.e., USD, EUR, AUD, NZD, GBP, SGD, JPY, CHF, HKD, CAD. The IC Markets MT4, MT5, and cTrader platform support the raw spread account.

Such an account offers the lowest possible spread ( like EUR/USD average spread – 0.1 pips). Experts IC Markets review say the deep liquidity and fast execution of this account’s trade help the day traders and scalpers win the trade. The account offers up to 1:500 leverage.

You can deposit money using credit/debit card, Neteller, Skrill, Neteller, wire transfer, ssBpay, etc. the trade size (lot) is flexible enough. You can afford the trade as per your fund. You can trade with 0.01 lot (one micro lot) too. Such flexibility in lot size minimizes the trade risk.

Standard account

You will experience ultra-fast trading speed using the standard account. This account charges no commission on the trade. Traders can open the Individual, corporate, or joint account as per their needs. The IC Markets MT4 and MT5 platform support the standard account.

Islamic account

Both raw spread and standard accounts offer the swap-free account. Believers of Islamic shariah have religious permission to use such Islamic accounts. The account provides 1:500 leverage at best. The IC Markets MT4, MT5, and cTrader platform support the Islamic account.

IC Markets demo account

The demo account is the medium to learn how to trade in the forex market. You use fake money, so there is nothing to lose indeed. Opening an IC Markets demo account is pretty simple. Just fill-up the required information and submit then get your report free. Using the IC Markets demo account, you can experiment with trading and learn different trading strategies free of cost.

Once you are ready to trade in the market, open the IC Markets live account. Opening the live account takes a much short time. You will receive immediate funding right after opening the IC Markets live account. You can enjoy trading around 200 products by running the trade from a live account.

IC Markets offer Micro accounts and Islamic accounts too. The account opening is wholly digital and hassle-free. The traders can trade around 64 currencies on applying standard commission on the trade. They don’t have any hidden trade charges. All types of accounts are equally compatible and ensure the best user experience.

Trading Platform

You can trade using MT4, MT5, and cTrader platforms. Access the platforms from any web browser. Both android and ios support the platforms. The platforms have a user-friendly interface and are available in different languages. You can access the market using the web, desktop, or mobile application.

In our IC Markets review, experts say, IC Markets trading platform comes with fair trade analyzing tools and educational resources. You will find different charting tools, forex calculator on their website. They provide educational writing and blog on forex, CFD trading to clear the trader’s concept. Video tutorial and web TV are their notable media to help the traders.

Deposit and Withdrawal

After opening the account, you will need to deposit money to start trading. IC Markets offer a vast range of deposit options; however, we will recommend wire transfer, e-wallets, Gpay, Apple Pay such as Neteller and Skrill, and debit or credit cards.

However, IC Markets does not charge any transfer fees for card payment, while they charge for bank transfer and international transfer. The broker to broker transfer opportunity is available as per your request.

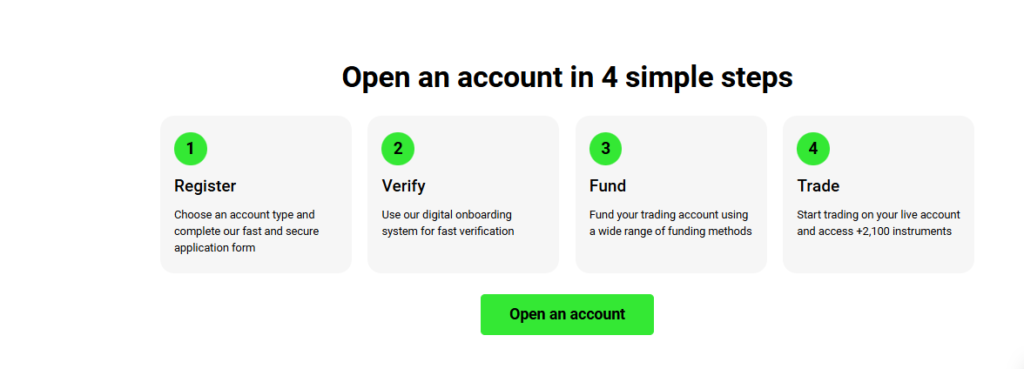

How To Open Account an IC Markets

The account opening process is online, and you don’t need to go to the office or any physical location to verify. After filling up the form to open an account from their website, IC Markets may take 24 hrs. to verify your information. Once they verify, you can deposit money and start trading. The information you will have to provide as per Know Your Customer (KYC) are-

IC Markets Pricing

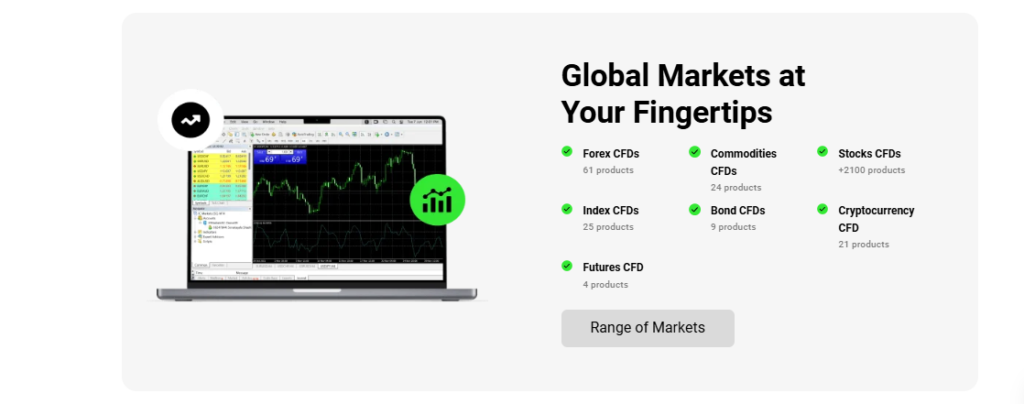

The minimum trade changes with the variation in forex account types. IC Markets leverage is different for a different product. The market offers varieties of forex products in seven different categories. The trading instruments are Forex CFD, Crypto CFD ,Indices CFD, Commodities CFD, Stocks CFD, Bonds CFD,

The spread differs from varying the account. All accounts offer the lowest possible spread. You can choose between spread only and commission inclusive trade depending on the trade. The market offers a low trading charge. And there is no charge of inactivation.

IC Markets Bonus

Unfortunately, the market doesn’t offer a bonus in trading. Despite the IC Markets bonus, the trade is always a win for the trader. So trading without a reward in the IC Markets is not that bad.

You need to know some common trading strategies to run the smooth trading irrespective of the forex broker.

Education and Research

IC Markets has a comprehensive educational section that provides details about forex trading, technical analysis, fundamental analysis, risk management, trading psychology, and strategy. These educational resources are provided in the form of blog posts and videos.

If you are a complete beginner when it comes to platforms, you should rest easy because it has tutorials for the platforms they provide. As for research, you can find most of the information you need from their ‘Information Hub for Serious Traders’ section.

There, you will see categories like company news, fundamental analysis, technical analysis, education, and trading data. There are regular updates on the Weekly Outlook and review posts. The economic calendar is on the homepage, as well as a forex calculator.

Customer Service Experience

As with any broker, you could meet challenges and other issues that need addressing. To get it right, you may need to call, email, or text the customer support. You’ll be glad to know that they are prompt, accurate, and helpful.