- Limited Asset Coverage

- Platform Selection Limited

XM brokers has earned a top position in the forex brokerage list by providing top-notch service. XM trading platforms are available for all level traders. XM review are a reliable source to know about the broker if you research them before trading. We will be reviewing the XM broker and will let you know the benefit and drawbacks of trading with the XM broker.

The XM broker was founded in 2009 by a group of interbank dealers looking to expand the forex market’s services. In our XM review, we see that the company has transformed into a broker with many online assets. It has headquarters in the Republic of Cyprus and is registered under the name Trading Point of Financial Instruments Ltd.

XM Group (XM) is a group of regulated online brokers. Trading Point of Financial Instruments Ltd was established in 2009 and it is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10), Trading Point of Financial Instruments Pty Ltd was established in 2015 and it is regulated by the Australian Securities and Investments Commission (ASIC 443670) and XM Global Limited was established in 2017 and is regulated by the Financial Services Commission (000261/397).

Overview

- Headquarters: Belize, C.A

- Regulatory : IFSC, CySEC, IFSC, ASIC

- Trading Platforms: MT4. MT5,Webtrader.

- Foundation Year: 2009

- Min. Deposit: $50

- Max. Leverage: 1:1000

- Deposit Options: Bank Wire, VISA, MasterCard, Neteller, Skrill.

- Customer Support: 24/7

Regulation

As we mentioned earlier, this company is heavily regulated in many jurisdictions in the world. Some of the most significant regulation agencies that oversee it are:

- The Cyprus Securities and Exchange Commission ( CySEC )

- The Belize Financial Services Commission (FSC)

- The Australian Securities and Investment Commission (ASIC).

- The Dubai Financial Services Authority (DFSA)

All of these regulatory agencies are from first-world countries with strong law enforcement measures in place. When trading with this broker, you will not have to worry about safety. We also found out during this XM review research, that the broker is more widely regulated.

They are registered in over 10 European countries, each with a different regulatory agency like the FSB, AMF, CONSOB, ACP, FIN, KNF, FI, and Europe’s MiFID. Each of these agencies oversees countries like Spain, Italy, Hungary, Poland, Netherlands, Italy, and Sweden.

There is no doubt that XM is one of the leading forex brokers on the planet. To offer additional investor protections, the broker also does the following:

- They have an investor compensation fund under the CySEC jurisdiction of up to €20,000

- Clients enjoy negative balance protection in any jurisdiction so that they never lose more than they deposit.

Bonus for Deposits & Promotions

XM global gives out a non-deposit $50 trading bonus to new clients who have just signed up. They also offers a two-tier bonus on deposits that could go as high as $10,500. To find out more about this, you should read their full terms and conditions to ensure that you are eligible for something.

At the time of writing this XM review, there are promotions where clients get a deposit bonus of up to $500 and up to $10,500.

Clients registered under the Trading Point of Financial Instruments Ltd and Trading Point of Financial Instrument Pty Ltd are not eligible to receive bonuses.

Withdrawal and Deposit Options

XM review details show that they have a 0% policy on deposits and withdrawals. All e-wallets, major credit cards, and wire transfers above $200 are all covered. Account funding is instant, with no hidden fees or commissions on withdrawals and deposits.

At the XM broker, there is no actual minimum. Even the $5 minimum deposit is imposed to adhere to the restrictions placed on electronic funding platforms like Skrill and Neteller. You can use Nganluong Wallet, Neteller, Skrill or Online Bank Transfers to withdraw money.

Withdrawal of amounts that are under $200 falls subject to a $15 administration fee. This is not uncommon, either. However, it is a little unusual as it forces the smaller depositor to consider when to make the withdrawal and when to sit tight and wait for the profits to go above $200.

Generally, minimum deposit is great for small-time traders who cannot afford to pay $100 or $200, which is the standard requirement for many competitors who go up against XM.

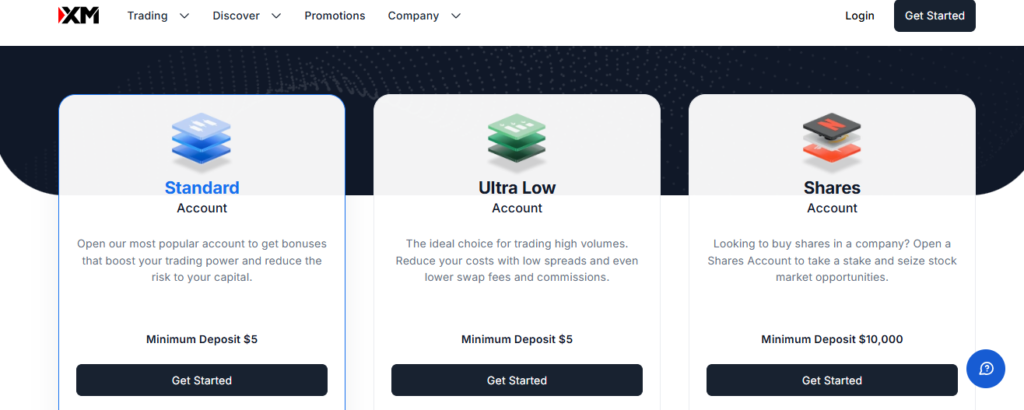

Account Types

There are four major account types, plus the XM demo account. To understand what XM account types can offer you, we are going to break them down. That way, you will match your ability, strategy, and budget to the right one.

Here are some of the best features our XM review found out about the accounts:

- You can trade both standard and micro-lots.

- There is unlimited access to expert advisor trading on MT4 and MT5.

- You can access technical analysis and free intra-day market updates.

- The execution speeds are the same on all accounts.

With a low and competitive minimum deposit of $5 across all of them, it is correct to say that anyone can open an account. As we mentioned earlier, XM account types are not designed to target high-volume traders. They are ideal for traders who do not stake too much or trade vast amounts.

XM Micro account is low-cost and easy to use. With a low XM minimum deposit of $5, it comes in as one of the cheapest accounts to open.

You can use the leverage of up to 1:1000, without commissions. You will pay broker fees with spreads. There is negative balance protection to ensure that you never lose more money than you deposit.

With the XM micro account, you can open up to 300 positions at the same time.

Customer Service

To reach XM customer service, you will need to use telephone numbers, email, or their live chat function. The live chat function is the fastest to respond. The first question gets answered in a few seconds. Sometimes, you will not get the best answers you are looking for.

However, there is no need to worry because you can call them and talk to a customer service agent if that does not work. An email will take about a day before you have your answers. They are more relevant than the phone or live chat answers, which can be vague at times.