- Competitive Spreads

- Comprehensive Educational Resources

- Robust Customer Support

- Limited Deposit and Withdrawal Options

- Occasional Platform Glitches

- Limited Regulatory Oversight in Certain Regions

We want to welcome you to our comprehensive Alpari review. Whether you’re an experienced trader looking to explore different brokers or a beginner, you’ll find this review helpful. At TopBrokers, we specialize in providing traders with firsthand knowledge and understand the importance of making informed decisions. This is why we’re committed to providing the most thorough broker reviews and resources.

Deciphering all the broker options can be overwhelming. Here, we’ve looked at important criteria points to assess how Alpari performs and compares to other top brokers. Consider this your ultimate guide to understanding Alpari to make the most educated choice.

- Headquarters: Saint Vincent

- Regulatory : FCA, FSC

- Trading Platforms: MetaTrader 4, MetaTrader 5

- Foundation Year: 1998

- Min. Deposit: $/€ 300

- Max. Leverage: 1:3000

- Deposit Options: Bitcoin, Skrill, Wire Transfer, VISA, Master Card, Neteller

Accounts

Type of Alpari Trading Accounts

Alpari International offers its clients a variety of trading account types to suit their unique trading styles and experience levels. In addition to the standard demo account, the Broker provides six different account types that use real money. Let’s take a closer look at each one.

Forex Standard Account

This is a great choice for intermediate traders. It provides a user-friendly and safe trading environment with floating leverage up to 1:1000 and no commission charges. With a minimum deposit of just $100, traders can start executing trades with narrow spreads from 1.2 pips on popular currency pairs.

Forex Micro Account

This is an ideal option for beginner traders. This Alpari trading account operates like a traditional account but allows traders to execute trades in cents. It’s perfect for testing trading strategies or practicing trading skills. With a minimum deposit of only $5, beginner traders can start trading with floating leverage up to 1:400 and narrow spreads from 1.7 pips.

Forex ECN Account

This is tailored towards Advanced traders looking for a more immersive trading experience. This account offers flexible, transparent, and efficient trading conditions with floating leverage up to 1:1000. Traders receive the best bid/ask prices from trusted liquidity providers, allowing for more efficient trades. With a minimum deposit of $500 and commission charges of $1.5 per lot per side, traders can expect narrow spreads from 0.4 pips.

Forex Pro Account

This Alpari trading account is for professional investors, active traders, and hedge fund managers. It offers the best liquidity, faster trade execution speeds, and the tightest spreads imaginable. With floating leverage up to 1:300 and no commission charges, this account maximizes the trading strategy of experienced traders who know what they want from their trading accounts. The minimum Deposit for this account is $25,000.

Trading Instruments

One of the biggest benefits of choosing an Alpari broker is their diverse range of trading instruments. These include forex, commodities, stocks, indices, crypto, and metals. This range of trading instruments offers clients the ability to diversify their portfolios and explore new trading opportunities.

Spreads and Commissions

Alpari is competitive with other top online brokers in the area of spreads and commissions. Currently, they offer spreads starting at zero, and low commissions. There are zero commissions with their Standard and ECN accounts. With the Pro ECN account, commissions range based on the type of trading instrument.

Forex, metals, and CFDs are charged a commission of $25 per million notional. There is a 0.05% commission notional on crypto, and a $0.02 per side commission on stock CFD using MetaTrader 5 only.

Leverage and Margin Requirements

We consider leverage and margin requirements to be an important component of our Alpari broker review. Leverage is used to enhance buying power by essentially borrowing from the broker. A leverage ratio of 1:100 indicates a broker will offer 100 dollars for each dollar of client capital.

The leverage offered by Alpari depends on the market, size of trade, and account type. Alpari offers a leverage of up to 1:3000.

Because leverages come with a risk to a broker, they require a margin to protect their assets. A margin is akin to a client’s downpayment for leverage. It’s there to cover any losses from trading. Alpari doesn’t offer a single margin level. Instead, it’s calculated per basis, combining factors such as the type of trading instrument and account level.

Trading Platforms

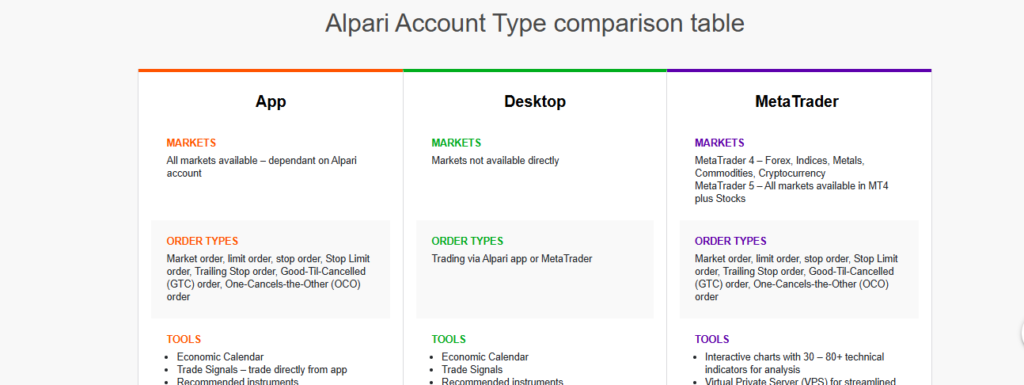

Alpari offers MetaTrader 4 (MT 4) and MetaTrader 5 (MT 5) as their trading platforms. MT 4 and MT 5 are among the most popular trading platforms used by traders globally. There are similarities between the two platforms, but the important details can be found in how they are different.

Overall, MT 5 offers more robust features, however, MT 4 is best suited for trading commodities, forex, metals, and indices. With MetaTrader 5, there is also access to stocks, along with advanced trading tools and more extensive trading options.

Both of the MetaTrader platforms are known for their user-friendly interfaces and popularity, especially among forex traders.

Additionally, Alpari also offers its own mobile trading app, which is a great option for new traders. It can be downloaded on both iOS and Android devices, putting easy trading in the palm of your hand.

Customer Support

Alpari earns a decent score for customer support. Like most online brokers, there are some pain points with response times and issue resolution. However, overall, the level of client satisfaction with customer support is above average.

There are multiple avenues for connecting with the Alpari customer support team. They can be reached via phone, email, and chat. Because Alpari has a global presence, they do prioritize having a multilingual support team to meet every client’s needs.

Educational Resources

Alpari offers educational resources that are designed to educate and instill confidence in novice traders. Along with this, they also offer continual learning opportunities for traders who are navigating the complexities of advanced trading.

Educational resources include in-depth guides into various trading instruments. Throughout its site, Alpari also infuses educational content into each area of interest.